16585,73%-1,05

43,92% 0,12

51,91% 0,09

7434,92% 1,41

11883,52% 0,57

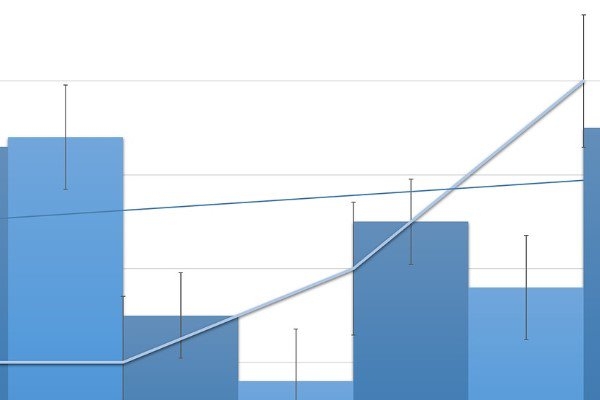

Unemployment rate in october, which was 11.2% in the same month of the previous year, decreased by 1 point to 10.2%. When compared to the previous month, it is seen that the adjusted unemployment rate increased by 0.1 points from 10.1%. In october, the number of unemployed rose by 57 thousand to 3.53 million. The youth unemployment rate rose from 20.1% to 21.9% in october. The composite measure of labor use, called the 'broad unemployment rate', remained unchanged at 20.3% from the previous month.

When we look at the comparable periods, October 2021 - October 2022, it is seen that there is an increase of 1.6 points in the labor force participation rate between the relevant periods, with adjusted data. The workforce, which was 33 million 238 thousand people in the similar period of 2021, became 34 million 734 thousand people in October 2022. The labor force participation rate increased from 51.9% to 53.5%. Again, looking at the seasonally adjusted data; The employment rate increased by 1.9 points compared to the same period of the previous year and became 48%, while seasonally adjusted employment increased by 229 thousand people compared to the previous month.

Unemployment Rate in Turkey, %; Participation rate and number of employees… Source: TurkStat, Tera Yatırım

There is no significant change in unemployment compared to the previous month. On the other hand, despite the good growth performance throughout the year, both main indicators and general indicators maintain their high double-digit levels. As reflected in the PMI data, the demand indicators in the industry decreased especially in the framework of the decrease in new orders. The loss of momentum, whose partial signs we have seen in both the headline GDP growth and sub-indicators, especially production, with 3Q22 will become more evident with both internal and external factors in 4Q22 and will naturally exert pressure on employment.

It is very possible that the effects of the slowdown in economic activity on the labor market will be reflected primarily on production indicators. We expect the loss of momentum observed in leading data in 4Q22 to be reflected in employment data. With the interest rate cuts, it is aimed to support the growth momentum of the real sector, and it is aimed to increase the production, employment and investment tendencies of the companies. We foresee the continuation of this economic approach. However, inflation and global recession concerns limit the investment horizons of companies. The limited transfer to market rates and the compelling effects of the sub-criteria on loan utilization is a phenomenon that may limit the growth reflection of loose conditions. We will see the effects of the regulations, especially the minimum wage, which may affect the employment market in the future. We may see an increase in both general unemployment and youth unemployment rates, as the growth momentum will decrease further in the coming year. We expect the unemployment rate to rise above 10.5% at the end of this year, and to test over 11% for a period next year. As a footnote, we still attach importance to youth unemployment and broadly defined (idle workforce) unemployment rates in terms of underestimation of the workforce.

Kaynak: Tera Yatırım-Enver Erkan

Hibya Haber Ajansı

Veri politikasındaki amaçlarla sınırlı ve mevzuata uygun şekilde çerez konumlandırmaktayız. Detaylar için veri politikamızı inceleyebilirsiniz.